Venture Capital Returns Model Template

- This is a digital download purchase. You will need Microsoft Excel to open and work with this file.

- After purchasing a template with consultation, please proceed to the booking page to schedule your consultation.

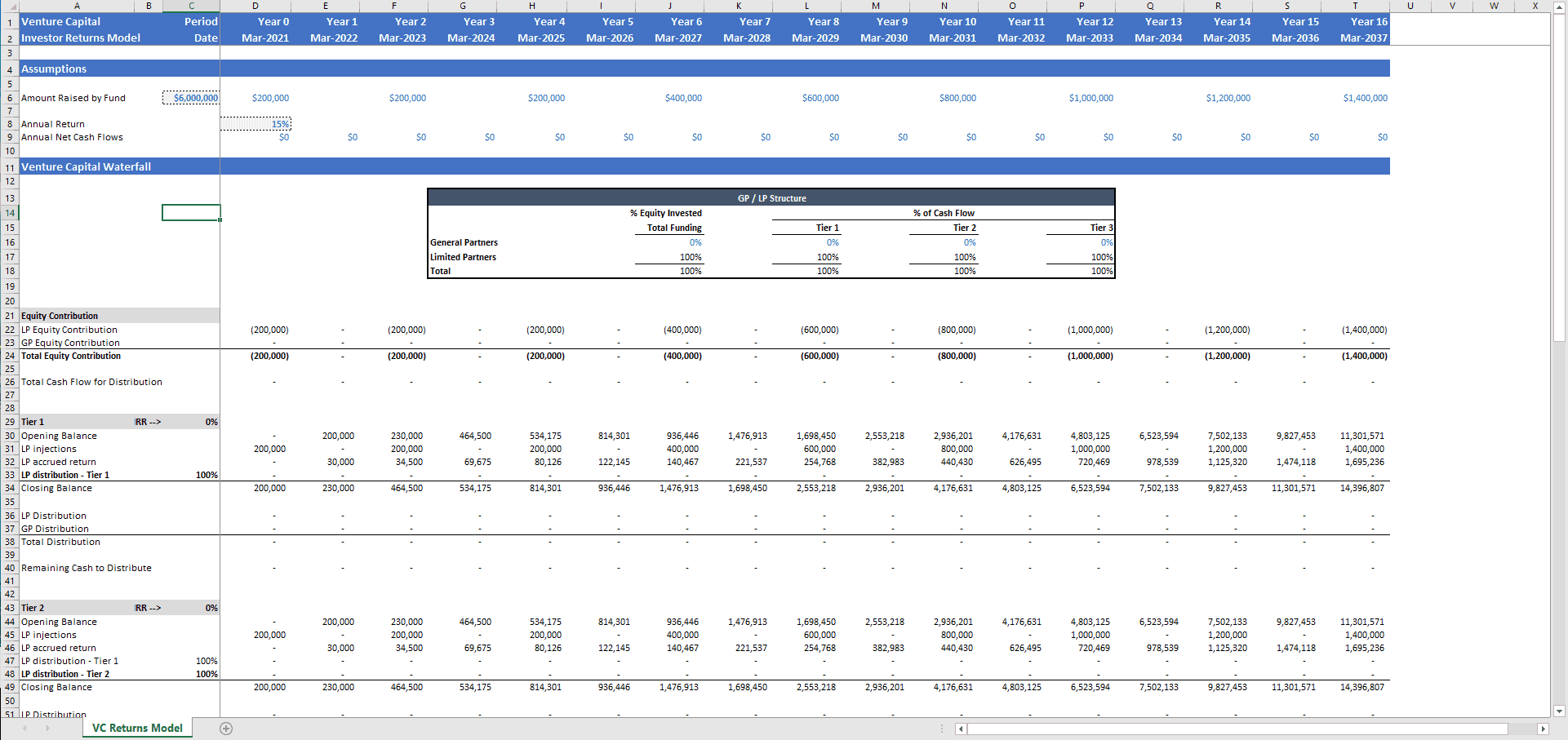

Venture Capital Returns Model Template

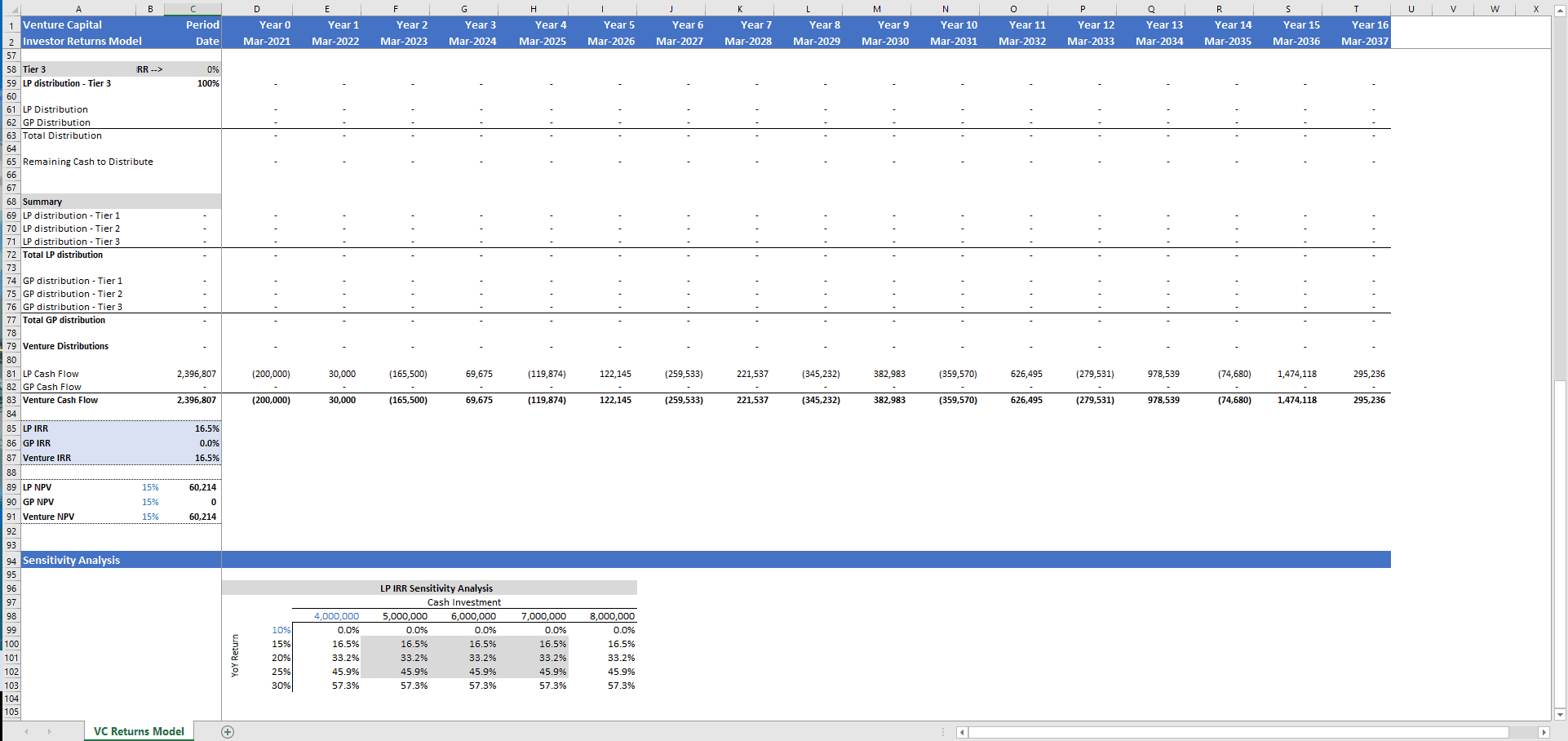

The Venture Capital Returns Model is used to provide an analysis into an investment return for a VC fund. This model includes a distribution waterfall and IRRS and NPVs for all partners in the fund and the fund in total.

The model starts with an Assumptions Section where you can enter in the amount raised, expected return and net cash flows distributed. The two cells highlighted in gray are tied to the Sensitivity Analysis at the bottom. The Venture Capital Waterfall breaks down the Equity Contribution and the distributions to the LP and GP investors.

The allocation percentages for equity invested and cash flow distributed can be adjusted in the GP/LP Structure box. Accrued Return is based on the IRR for each tier. After that, the model contains Net Present Value (NPV) and Internal Rate of Return (IRR) for each investor and the fund in total. Lastly, there is a sensitivity analysis for LP IRR based on Cash Invested and YoY Return from the Assumptions Section.

All cells in blue font are input cells where custom information can be entered. All cells in black font are formulas set to streamline the model.

"Guiding businesses to achieve financial success through advanced tools and professional advising."

Business Address

5900 Balcones, Suite 4000

Austin, Texas 78731

Business Hours

Monday - Friday

8:00 AM - 5:00 PM