Mobile Home Park Development Model

- This is a digital download purchase. You will need Microsoft Excel to open and work with this file.

- After purchasing a template with consultation, please proceed to the booking page to schedule your consultation.

Mobile Home Park Development Model

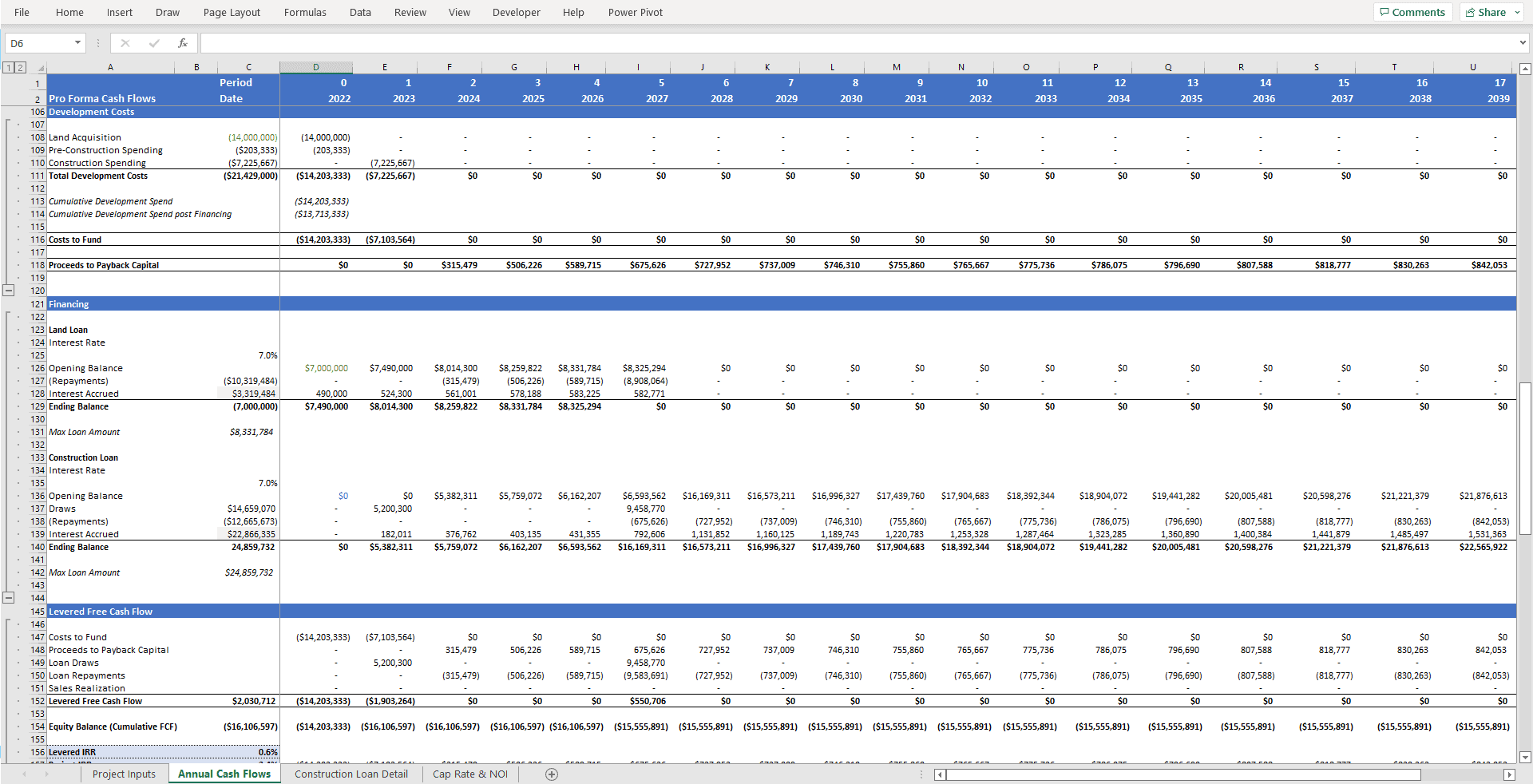

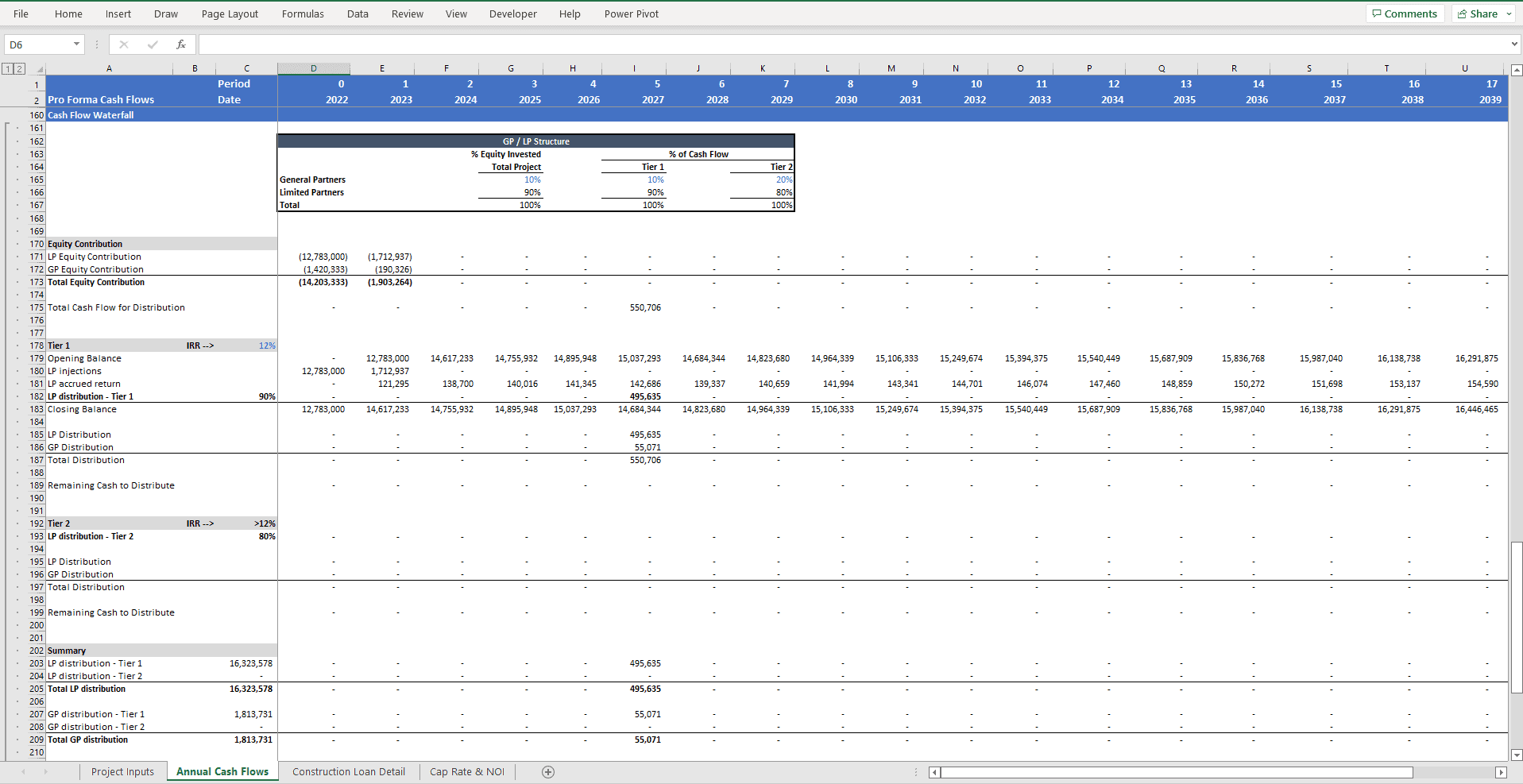

The Mobile Home Park Development model projects annual future cash flows from a mobile home park from the purchase of the land, to the rental of units to the sale of the property. This covers development costs, financing, levered free cash flow, and a cash waterfall for investors. The tabs included are:

- Project Inputs

- Annual Cash Flows through the purchase of the land, construction, and sale of property

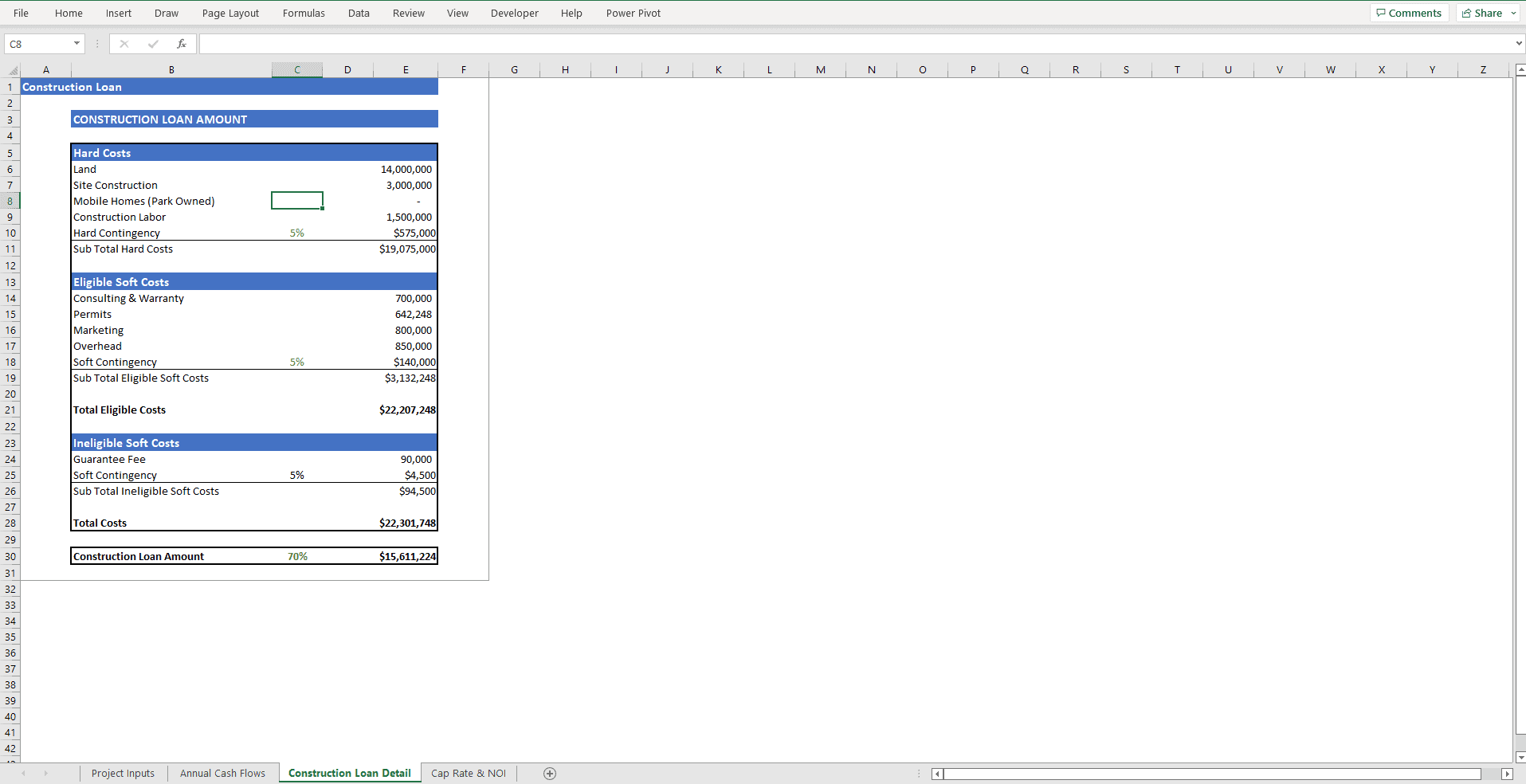

- Construction Loan worksheet

- Cap Rate & NOI

The model starts with the Construction Loan worksheets where you can break down certain costs that make up the construction loan. From there, the model goes into the Cap Rate & NOI. This tab offers net operating income and valuation for up to 5 different rental properties along with sensitivity analysis and scatters plot for Cap Rate and Rental Income.

Next, the Project Input tab is used to enter most of the assumptions that will drive the model. Here assumptions such as the construction schedule, development costs, finance terms, property mix and operating cost are entered and flow into the Annual Cash Flows tab. The model is built to allow for a refinance of the property; the refinance period, cap rate and loan to value can be adjusted. Holding period can be adjusted as well from a drop down menu on cell K49 with an associated cap rate.

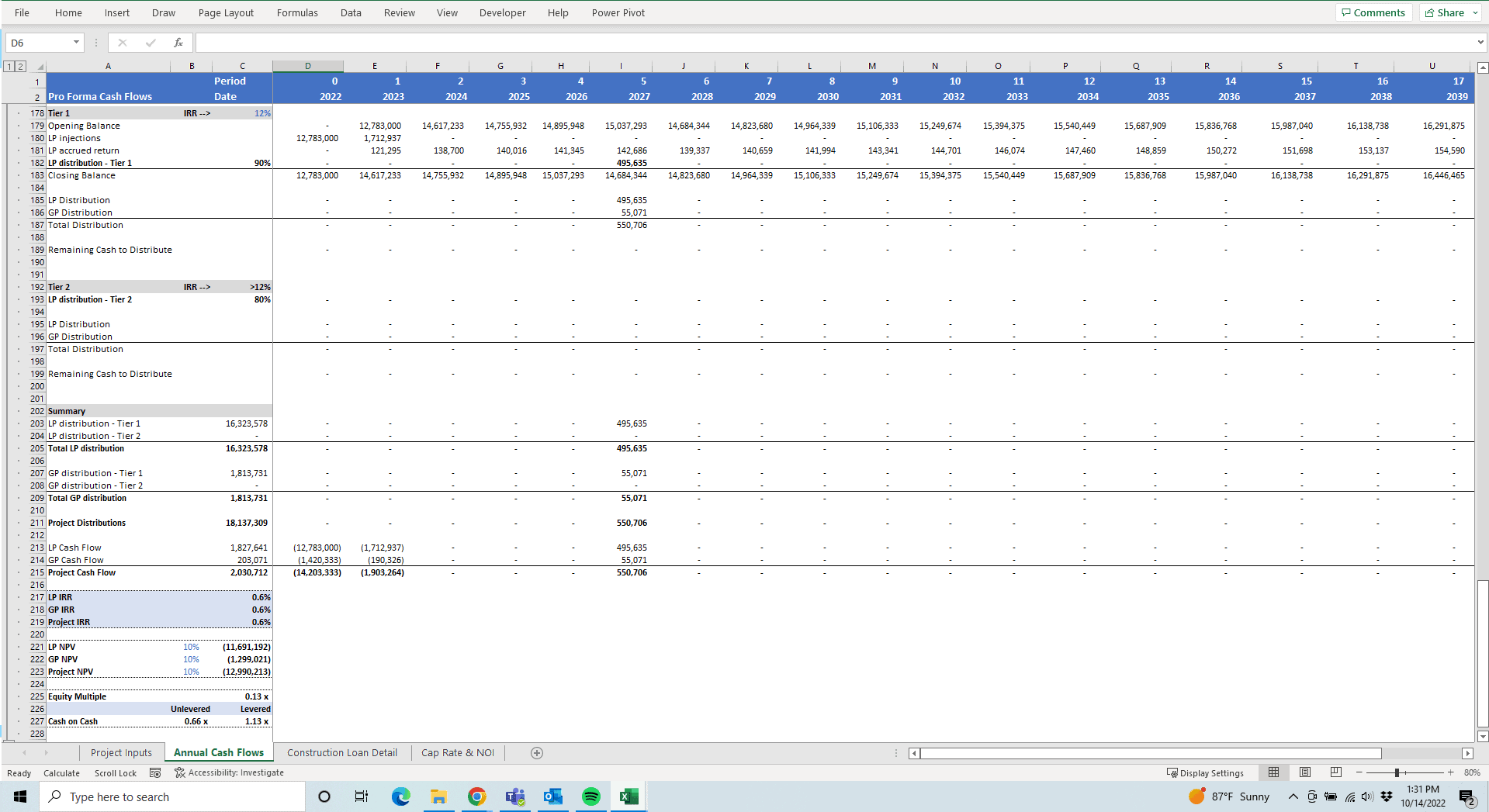

The Annual Cash Flows includes a three statement model with projected rent roll from construction to the sale of the property. This also includes important aspects such as development costs, financing, levered free cash flow, and a cash flow waterfall for investors. Occupancy for each period can be adjusted in row 12 to allow for variances in occupancy rate from period to period. In the Cash Flow Waterfall section, equity invested, cash flow distribution and IRR can be adjusted for GP/LP. In this section, IRR and NPV is calculated for GP/LPs and the project as a whole. Other metrics include Equity multiple and Unlevered/Levered Cash on Cash multiples.

All cells in blue font are input cells where custom information can be entered. All cells in black font are formulas set to streamline the model.

"Guiding businesses to achieve financial success through advanced tools and professional advising."

Business Address

5900 Balcones, Suite 4000

Austin, Texas 78731

Business Hours

Monday - Friday

8:00 AM - 5:00 PM