Real Estate Investment Fund Model – Rental Properties

- This is a digital download purchase. You will need Microsoft Excel to open and work with this file.

- After purchasing a template with consultation, please proceed to the booking page to schedule your consultation.

Real Estate Investment Fund Model – Rental Properties

This real estate investment fund model for rental properties projects monthly future cash flows from the renovation and rental of a multi-family housing properties as part of a real estate investment fund. This covers rent roll, project costs, financing, levered free cash flow, and a cash waterfall for investors. The tabs included are:

- Project Inputs with purchase and valuation figures for up to 10 rental properties

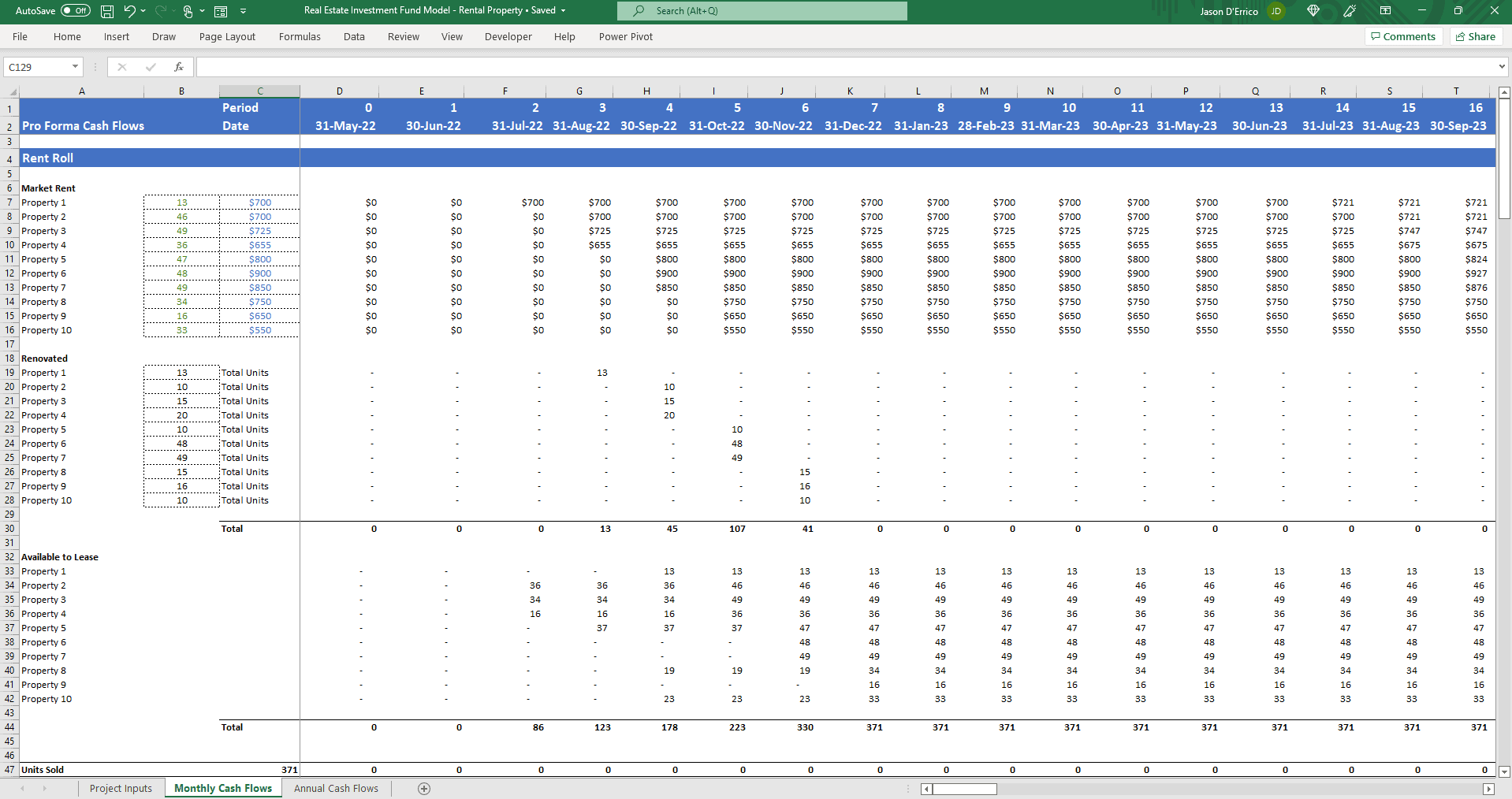

- Monthly Cash Flows through the renovation and rental of the multi-family properties

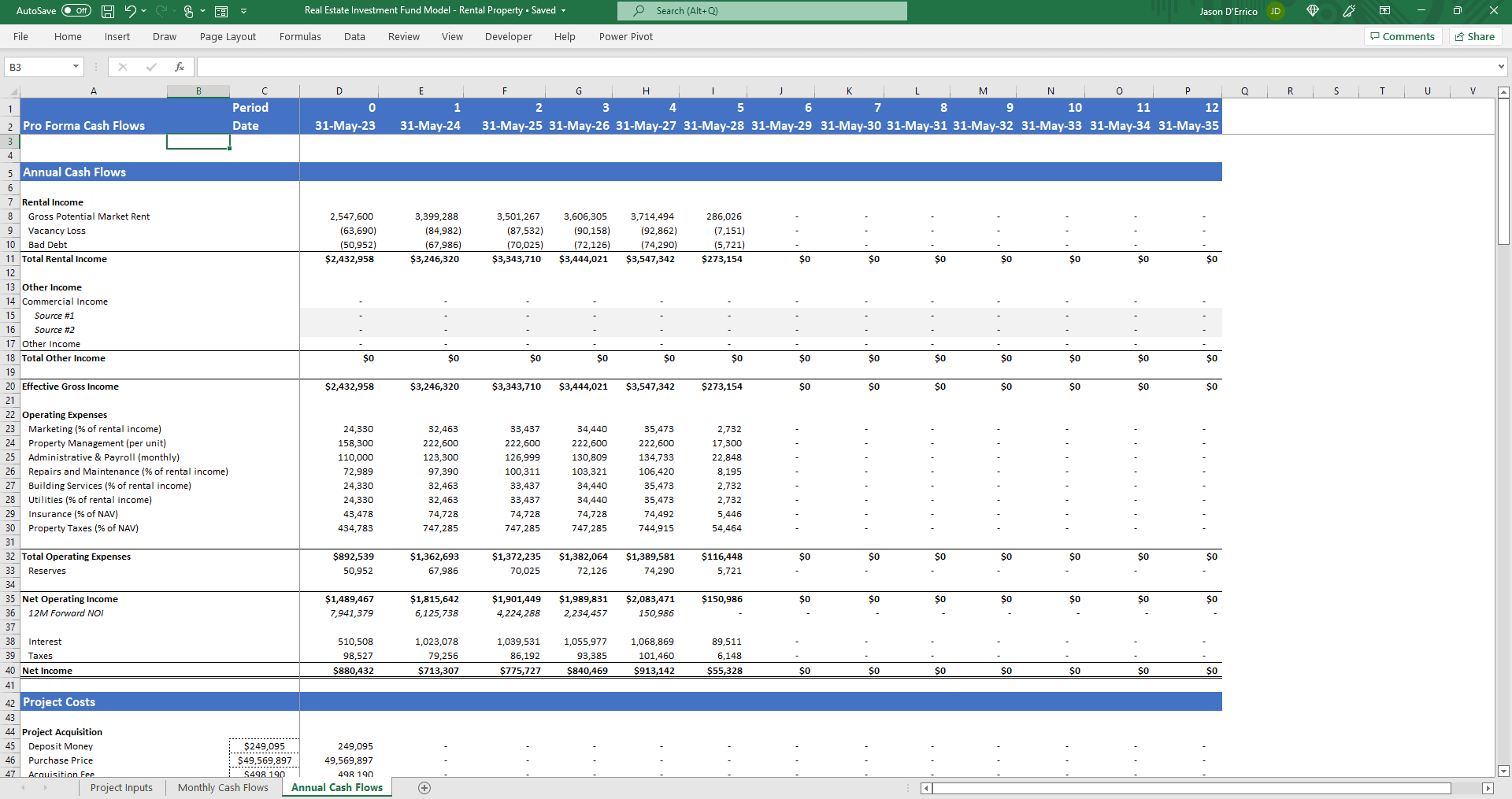

- Annual Cash Flows Summary

The Project Inputs tab of the Investment Fund Model contains the assumptions for each prospective rental property. Details of each of the properties such as the renovation schedule, operational costs, and finance options are entered in this tab and flow into the Monthly Cash Flows tab. The financing options account for a two loan during the life of the fund. This tab includes a capitalization and funding breakdown along with purchase and valuation assumptions for a potential exit strategy.

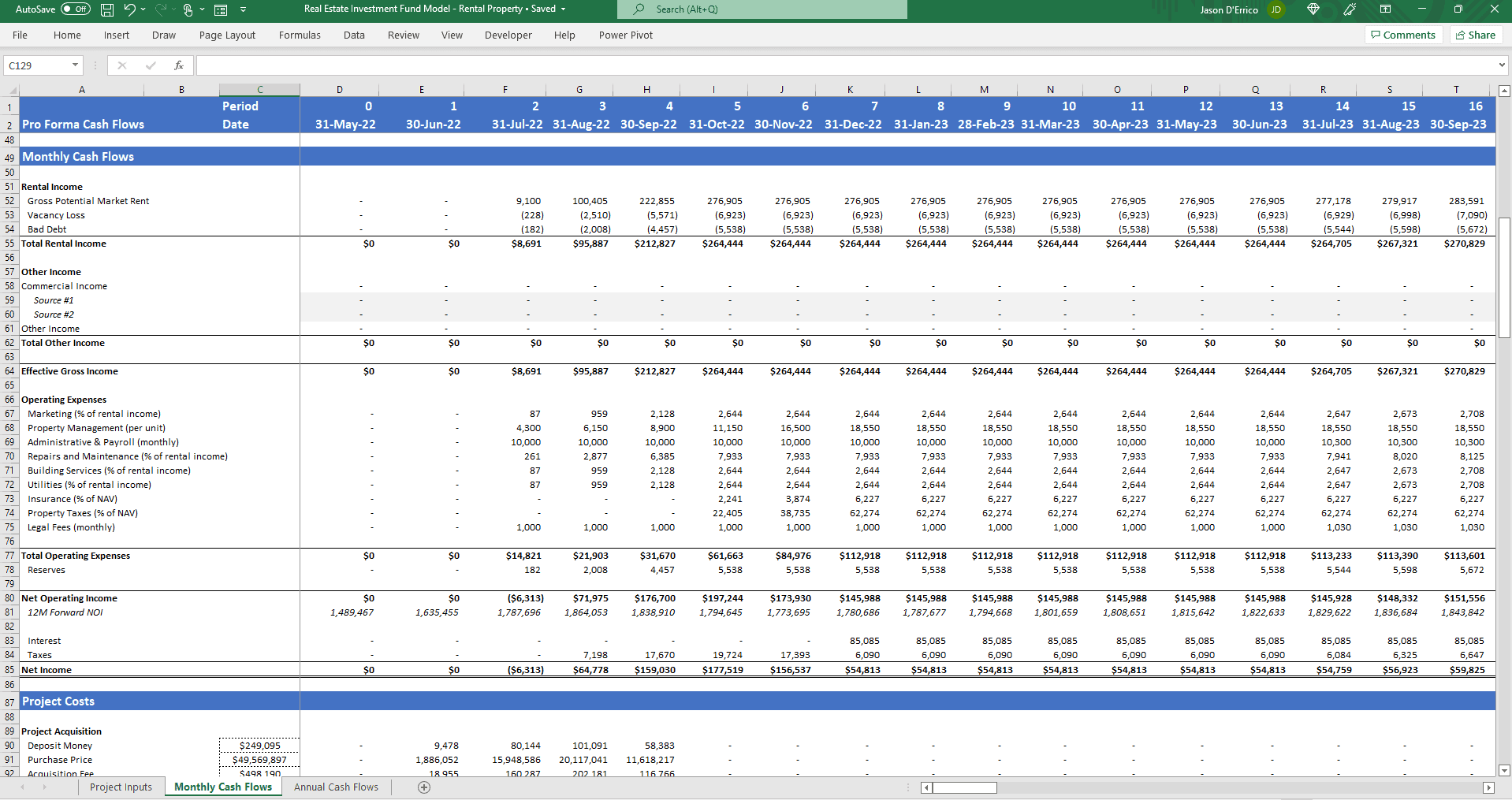

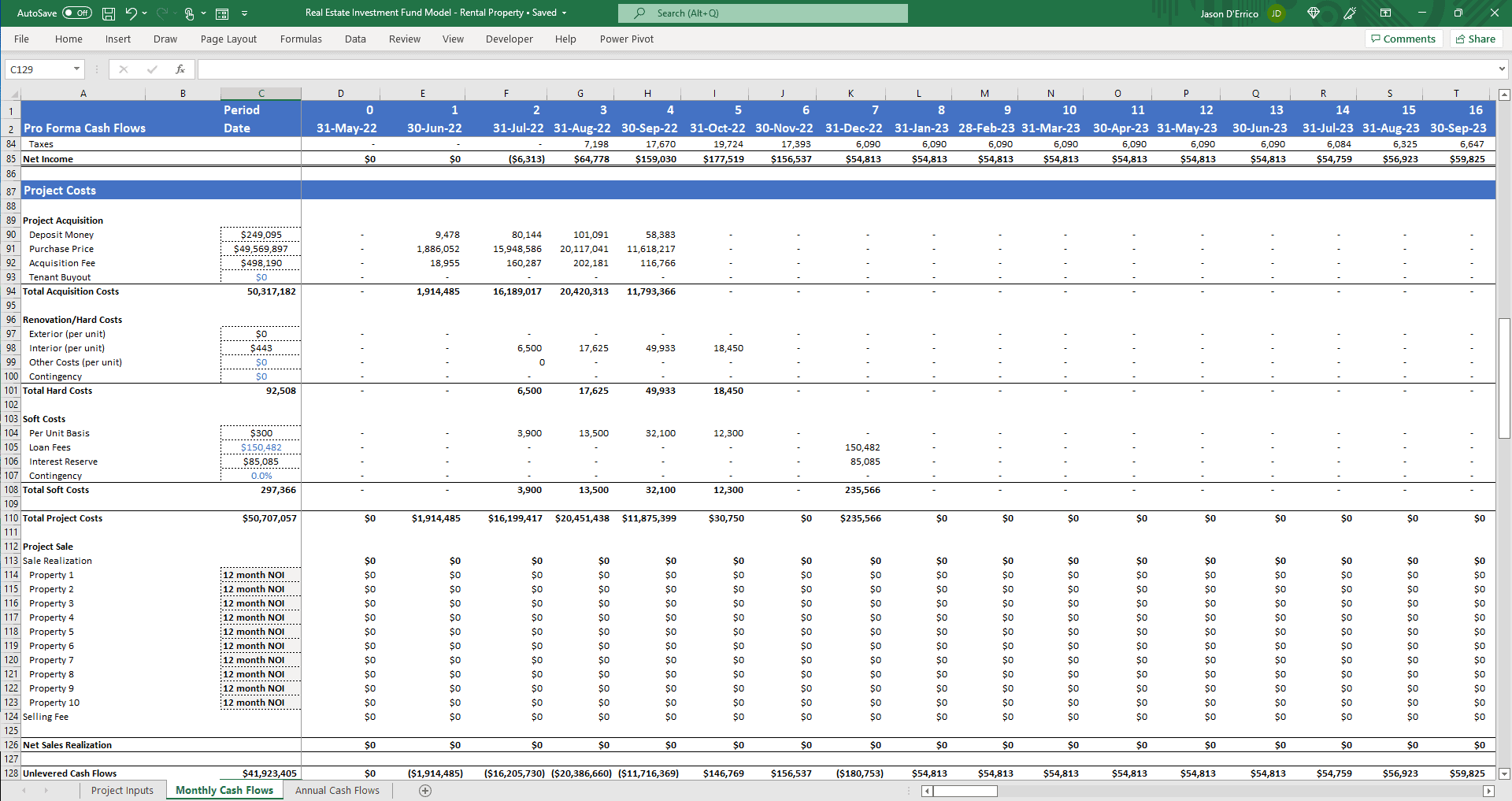

The Monthly Cash Flows is a proforma with projected revenue from the rent of the units after renovation and operating expenses from each property. The Project Costs Section is tied to the inputs tab and calculates the net sales realization and unlevered cash flows. For each property in the Project Sale section under Project Costs, there are drop-down menus to select the valuation of the property, using 12-month NOI or an appraised value from the inputs tabs.

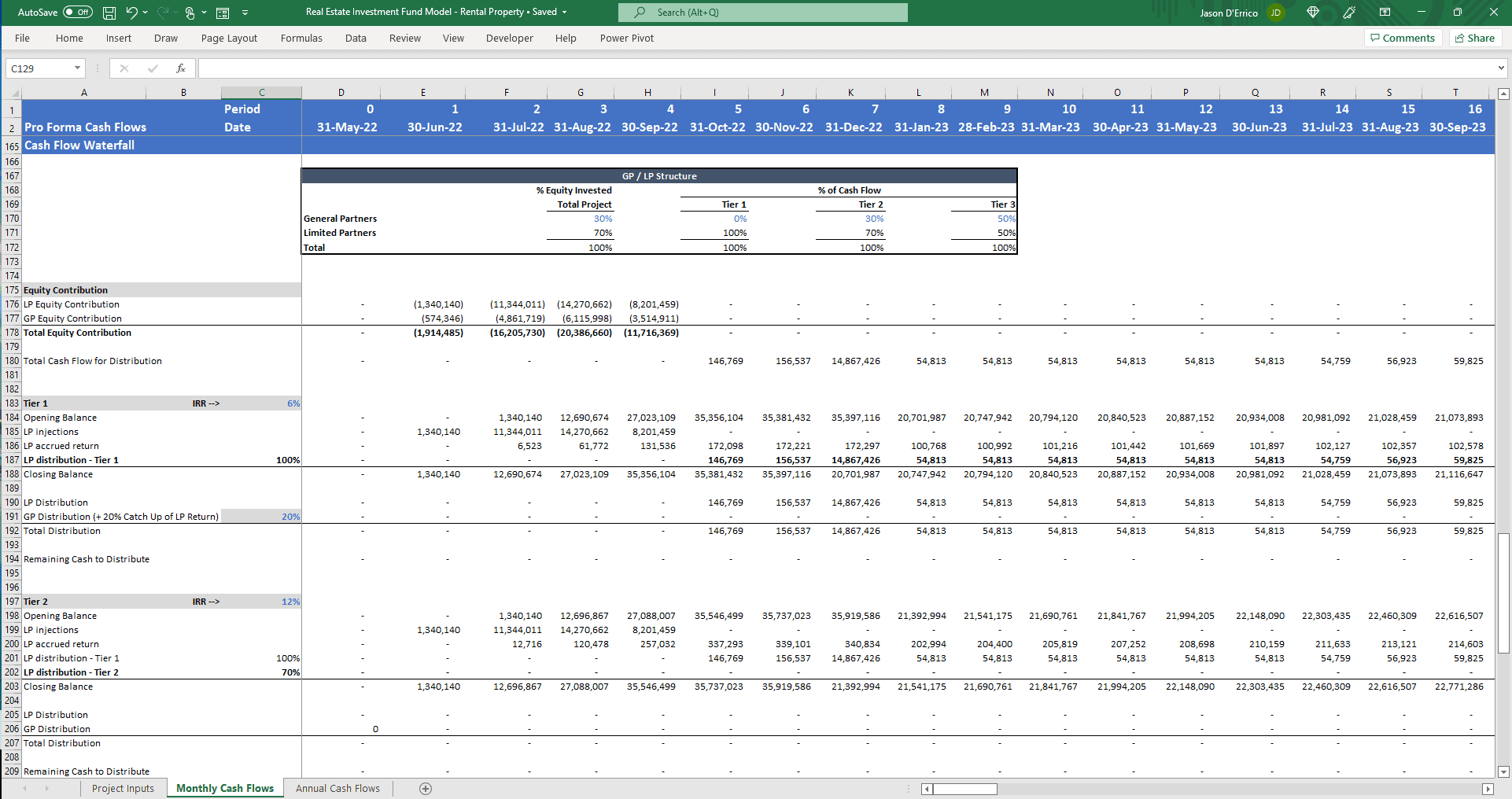

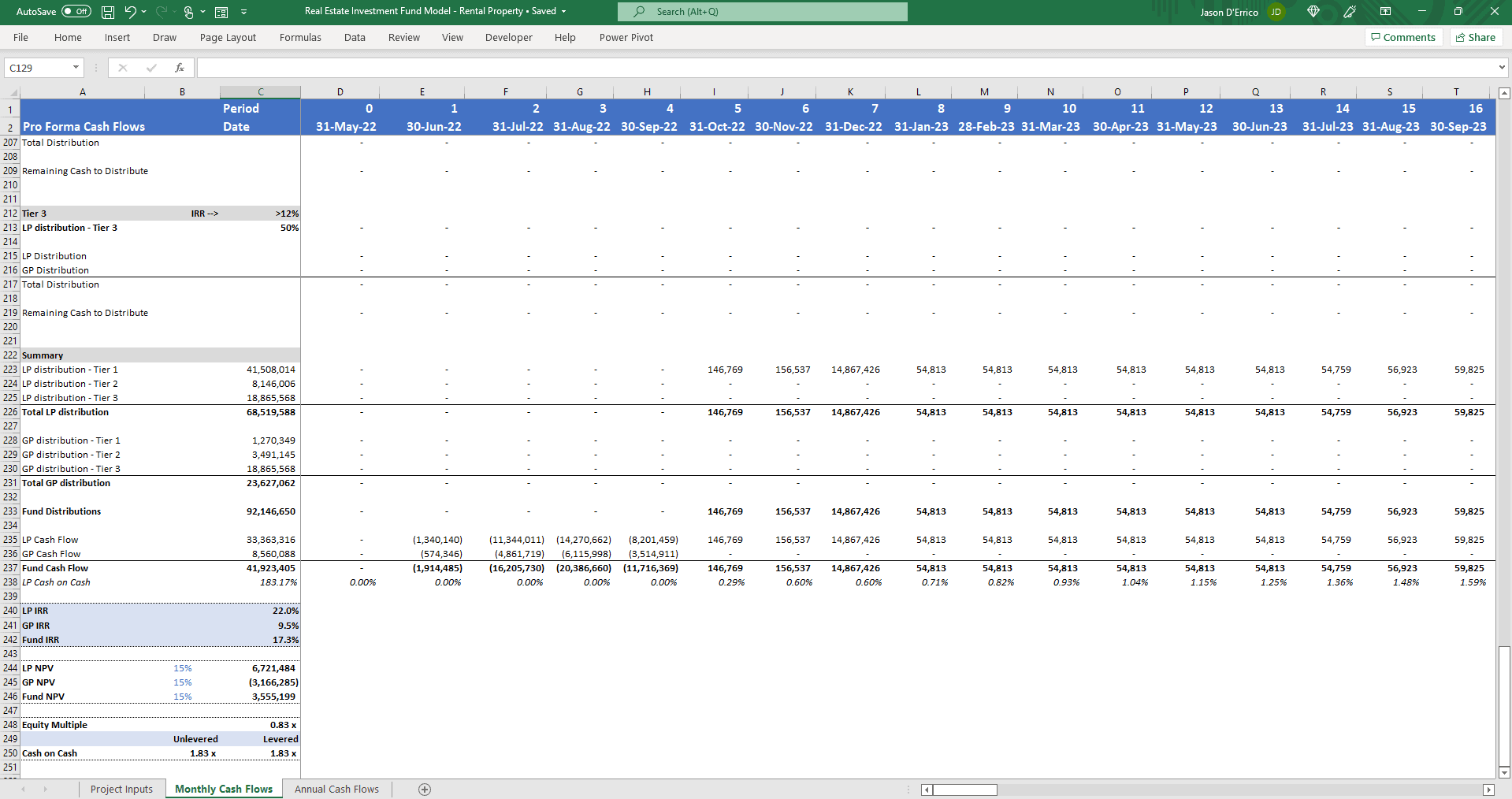

The Financing Section of the real estate investment fund model breaks down the two loan structures based on the assumptions. The Levered Free Cash Flow Section sums up the above sections to calculate the equity balance and IRR. Lastly, The Cash Flow Waterfall displays the contribution and distribution of the fund for investors. Built into the model is a GP catch up option after the first tier is satisfied for the LPs. This includes metrics such as IRR, NPV, Cash on Cash Multiple and Equity Multiple for the project.

All cells of the real estate investment fund model in blue font are input cells where custom information can be entered. All cells in black font are formulas set to streamline the model.

"Guiding businesses to achieve financial success through advanced tools and professional advising."

Business Address

5900 Balcones, Suite 4000

Austin, Texas 78731

Business Hours

Monday - Friday

8:00 AM - 5:00 PM